What is FLA return?

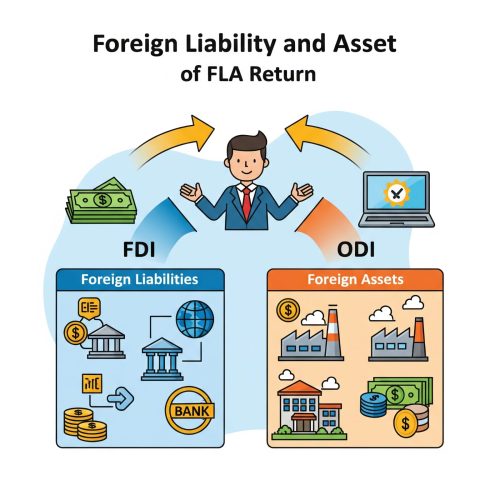

The Foreign Liabilities and Assets (FLA) Return is to be filed by every Indian Entity who have foreign direct investment (FDI) in the Entity or who have made such Foreign Direct investment outside India (Overseas Direct Investment – ODI)

As the name suggests it is a return for reporting Foreign Liabilities in an Entity (Details of Foreign Investment in the Entity) and Foreign Assets (Overseas Investment) made by the Entity.

The due date for filing the FLA return is 15th of July every year. If you miss the deadline, then late fees and penalty shall be levied as per Foreign Exchange Management Act, 1999( FEMA Act, 1999).

There is no fee that is levied on filing of the return but late filing or non filing of return shall be considered as a contravention of provisions under Foreign Exchange Management Act (FEMA), 1999.

When is FLA Return applicable?

FLA return is applicable when :

a) there are foreign direct Investment in the Entity during the previous Financial year(s) or current financial year and which are outstanding as on the 31st March of that year

b) there is overseas direct investment (Foreign Assets) made by the entity in the previous year(s) or current financial year and have an outstanding balance in the balance sheet as on 31st March of that particular year

c) Received External Commercial Borrowings

NOT Required for:

a) Proprietorships, HUFs, Trusts

b) Individuals

c) Entities with no foreign investment or foreign liabilities/assets as on 31st March

Let’s understand this by a simple example:-

Scenario 1 : When foreign liabilities or foreign assets are made during FY 2019-20. Do we still need to report in the year 2025?

Yes, if there is outstanding liability or assets in the balance sheet as on 31st March, 2025, then you are liable to report and file FLA return by 15th July, 2025

Even if there are no transactions during the year then also return to be filed.

Scenario 2: When foreign liabilities or foreign assets are made during the previous financial year

Yes, in such case, the entity is liable to file Foreign Liabilities and Assets (FLA) return by 15th day of July

Meaning of entity for filing of FLA return:

The entity here means:

i) All companies as defined under Section 1(4) of the Companies Act, 2013

2) Limited Liability Partnership (LLP) which are registered under Limited Liability Partnership Act, 2008

3) Other entity including

– SEBI registered Alternative Investment Fund (AIF)

– Partnership Firms

– Public Private Parnership

Documents required for filing of FLA return:

A) Basic Company Information

B) Provisional or Audited Financial Statements

C) Details of FDI ( date of FDI received, amount, valuation, shares alloted, name and address of investor)

D) in case there is foreign assets, then details foreign assets are required ( name and address of foreign subsidiary/Joint Venture, Nature of Investment, Amount of Investment, Earnings from foreign entities

E) details of ECB, if any

F) number of employees on payroll

G) Shareholding pattern as on 31st March

Note – In case Audited Financial Statements are unavailable till 15th July, then the entity may proceed to file FLA return, on the basis of Provisional Financial Statements.

In case entity wish to revise the return already filed on the basis of Audited Statements, it is allowed to do so, but first it need to take RBI approval for the same. This facility is available on FLAIR portal of RBI.

How to report and file FLA return?

-The Foreign Liabilities and Assets (FLA) return is to be filed on FLAIR website – https://flair.rbi.org.in/fla/faces/pages/login.xhtml

Registration as entity user is must to access the website.

Entity may register on the FLAIR website by entering basic details. Verification letter and Authority letter is to be attached with the application for registration. Format for both letters are available on the website.

After successful registration, RBI will send mail on the email address registered within 1-3 working days.

The login OTP will go to this registered email address every time you login. Hence it is advisable to use only the permanent email address.

After login one can proceed to fill details. The FLA return is basically divided into 4 sections.

Section I pertaining to basic company information

Section II pertaining to Financial details

Section III Foreign Liabilities (Investment made in India)

Section IV pertaining to Foreign Assets

After filling details of the above sections, Variance Report is automatically generated. One can check all the details and then proceed to file the return to RBI.

An acknowledgment mail wil be received by the RBI. pertaining to basic company information

Penalty provisions under FEMA for late filing or non filing of FLA return

The late submission fees was introduced in year 2022, for late filing of FLA return. The LSF(late submission fees) for delay in filing of FLA is 7500 rs.

For continued delay the calculation for late fee is to be made using Formula [7500 + (0.025% × A × n)]

Where n is the number of years delayed

A = Amount involved in delayed reporting

Note – LSF should be applicable only if the delayed reporting is upto 3 years

In case a person responsible for any submission or filing under the provisions of FEMA, neither makes such submission/filing within the specified time nor makes such submission/filing along with LSF, such person shall be liable for penal action under the provisions of FEMA, 1999.

Conclusion:

The FLA return is to be filed by 15th July every year. The delayed filing can lead to late fees and penalties. FLA return can be filed on the basis of Provisional Financial Statements, hence one should not delay the filing waiting for Audited financial statements.

Even if there is no financial assets and liabilities in the current year, but there are outstanding balance in the balance sheet as on 31st March, then also entity is liable to file FLA return by 15th July, 2025.

We at https://legalsahayata.com specialize in FEMA, RBI returns. FDI/ODI advisoty and annual filings.

Contact us today at 8000028250 to stay compliant, stress- free and to get your FLA return professionally

#FLAReturn2025 #RBICompliance #FDIIndia #ODI #FEMA #StartupsIndia #FLAFilingHelp #KalpShahGST #BusinessCompliance #LinkedInIndia #LegalSahayata