GST Refund In case of Export of goods:

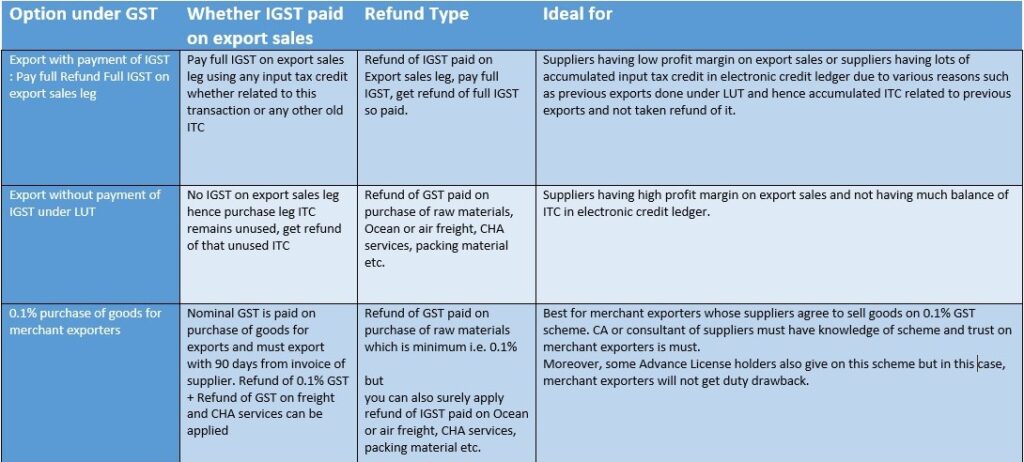

There are 3 ways to export goods in GST.

1) Export without payment of GST Tax (Without payment of IGST) -LUT Model

2) Export with payment of GST Tax (Without payment of IGST) – Pay full GST get Refund of Full GST model – Payment model

3) 0.1% SCHEME FOR MERCHANT EXPORTER SCHEME

1. EXPORT WITHOUT PAYMENT OF TAX (LUT)

Under this model you don’t pay any GST on export of goods because export is Zero Rated Supply. This means that government will not charge an GST on export of goods or services. And if any GST have already been charged in earlier stages of purchase chain then it will refunded to the person who ultimately export the goods or services. This means that at the time of export sale of goods in international market, you don’t have to pay any GST on export sales transaction and hencewhatever GST you have paid when you purchased the goods from domestic market remains unutilised or unsed. This unused GST paid at the time of purcahse is called Unutilized ITC of GST and you will get refund of such untilized GST. It was unutilized because government has not charged any GST on export sales transaction and on domestic purchase transaction you must have paid GST to your supplier at the time of buying the goods. You get the credit in of this GST paid at the time of purchase of goods if your supplier

(person from whom you purchase the goods) has paid this amount to government honestly. This credit is called input tax credit.or ITC. This ITC remains unutilized because you don’t have to pay GST at the time of export sales.

Now you can get the refund of this unutilized ( unused ) ITC by applying online on GST portal in form RFD 01 online.

Seperate procedure including statements, refund calculations, annexures and undertakings need to be prepared for which seperate fees is charged based on volume of transactions.

2. Export of Goods under LUT but purchase of Goods at 0.1%

Here, At the time of purchase of goods, instead of paying full GST, we GST pay 0.1% only. The supplier will not charge the GST at full Rate (5%, 12 %, 18%, 28%), but he will charge nominal GST 0.1%. Merchant exporter is under obligation to export this goods within 90 days. Merchant exporter should mention the GST number and Tax invoice number of the supplier from whom he had purchased the said Goods. And eventually, he will also provide the shipping bill and EGM numner under which the said goods have been exported. But obviously, he can hide the buyer details in the shipping bill by scratching it out or hiding by whitener or just simply tear that part. Simple. For more details read scheme for merchant exporters 0.1% concessional rate.

3. EXPORT WITH PAYMENT OF TAX (IGST)

As shipping bill itself is the application for Refund of tax paid, we just need to verify that all mandatory details of shipping bill are precisely entered in return, satisfying requirement of GST portal and ICEGATE portal, with a precondition that AD code and IFSC code is registered with customs.

How it works:

Exporter pays full GST IGST on export invoice just like a normal domestic transaction. However, he cannot collect GST from foreign buyer because we can export the goods but we cannot export the taxes.

The IGST paid can be claimed as refund under Rule 96 of CGST Rules.

Shipping bill is treated as deemed refund application.

Refund is auto-processed once:

EGM (Export General Manifest) is filed

Matching GSTR-1 and GSTR-3B is done

In brief, there is no seperate procedure for Refund of Tax in case of Export with payment of tax. Your shipping bill itself is your IGST refund application provided you file your GSTR 1 and GSTR 3B accurately and your IFSC code (Bank account for export promotion incentive option in icegate bank account) is registered at the port from where you are exporting the goods and it should not be PFMS rejected.

GST Refund for Export under LUT without Payment of IGST Export Under LUT:

Refund of GST Without Payment of Tax In India’s GST framework, exporters have a strategic advantage through the Letter of Undertaking (LUT) model, allowing them to export goods or services without payment of Integrated Goods and Services Tax (IGST). This article explains how the LUT model works, how to claim a refund of unutilized input tax credit (ITC), and walks through a practical example to simplify the concept.

What is Export Without Payment of Tax (Under LUT)?

Exports are treated as zero-rated supplies under the GST Law.

This means that No GST is charged on the final export sale.GST paid on domestic purchases (inputs and input services used for export) can be claimed as a refund by submitting proof of exports such as Shipping bill, Bank Realization certificate, EGM number, purchase invoice statement etc.

By furnishing a Letter of Undertaking (LUT) in Form GST RFD-11, an exporter can ship goods or services abroad without paying IGST at the time of export. The GST already paid on purchases remains unutilized and is eligible for refund.

- Real-Life Example:

Merchant ExporterLet’s break it down with a practical case:

A merchant exporter purchases goods from a manufacturer at ₹ 100, plus ₹1 8 GST(total ₹118).

He exports the goods to the USA with an FOB value of ₹160.

At this point, the exporter has two options:

Option 1: Export With Payment of IGST:

Pay GST @ 18% on ₹160 = ₹28.80Get refund of ₹28.80. Your shipping bill itself is your refund application if you file your GSTR1 and GSTR3B properly and your IFSC code is registered on Icegate portal.

Option 2: Export Without Payment of IGST (Under LUT)

Don’t pay any GST on ₹160

The earlier ₹18 paid to your supplier as GST (at the time of purchase)becomes unutilized ITC (Input Tax Credit), because you are not paying any GST on export sales leg. We File a separate refund application (Form RFD-01) to convert this unutilized ITC into cash.

Why This Refund on export of goods or services Exists?

In zero-rated export under LUT, since no GST is charged on the export invoice, the ITC on purchases used for that export is left unused. This balance of ITC is stored in your electronic credit ledger, and Can be claimed as a

refund after actual export and realization of

foreign currency. If your foreign buyer don’y pay you for any reasons, you are not eligible to get GST refund because realization of export sales proceeds is precondition for getting GST refund. Government wants foreign exchange to strenthen the economy hence all export incentives or refunds are directly linked with exporter getting payment in foreign exchange. No dollars, no Refunds or incentives, simple.

Documents Required for unutilised ITC Refund:

- To claim the refund of ₹18 unused ITC, you must file Form GST RFD-01 on the GST portal and attach following documents:

- Shipping Bill

- Bank Realization Certificate (BRC) or Foreign Inward Remittance Certificate (FIRC)

- EGM (Export General Manifest) number only : available on Icegate

- Purchase invoices used in the export (statement format)

- Export invoice statement including shipping bill details

- LUT Acknowledgment

- Declaration and undertaking

Please call us on 8000028250 or 9106359201 for GST refund related questions, queries and doubts.